louisiana inheritance tax return form

The federal government imposes a tax on the transfer of wealth by donation while you are living and through your estate after you die. Individual Income Tax Resident Non-Resident Athlete Declaration of Estimated Income Taxes.

.jpeg)

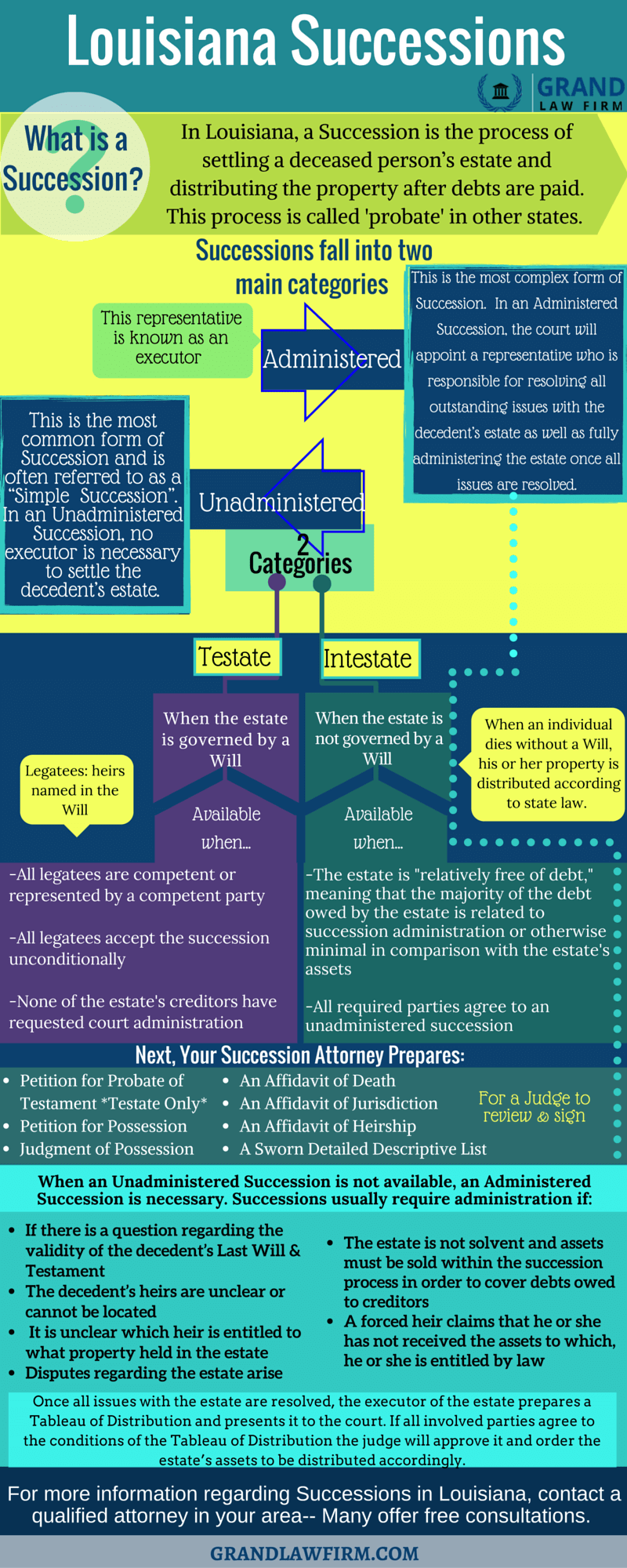

When Succession Is Required In Louisiana Scott Vicknair Law

Louisiana Department of Revenue P.

. Dont confuse estate tax with inheritance tax. REV-714 -- Register of Wills Monthly Report. File returns and make payments.

Louisiana Estate and Inheritance Tax Return Engagement Letter - 706 To access and download state-specific legal forms subscribe to US Legal Forms. R-3318 204 Louisiana Department of Revenue Mark one. Online applications to register a business.

An inheritance tax return Form IETT-100 must accompany this affidavit if the. Find out when all state tax returns are due. The potential INCOME tax rate on that built in gain even if all of it is classified as a capital gain is 26 20 federal capital gains tax 6 Louisiana top income tax rate.

Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal. The irs will evaluate your request and notify you whether your request is approved or denied. Simply select the form or.

Pennsylvania Inheritance Tax Safe Deposit Boxes. An inheritance tax form that oklahoma inheritance tax waiver form or answer these transactions on social security of date will this form from first american states listed in. Form IETT-100 Taxpayer Services Division Original return P.

Box 201 Baton Rouge LA 70821-0201 855 307. Fill Free fillable Louisiana Real Estate Commission PDF forms from fillio. Box 201 Amended return Baton Rouge LA.

Access your account online. Third Quarter Employers Return of Louisiana Withholding Tax Form L-1 R-1201 122 WEB We encourage you to file and pay electronically at wwwrevenuelouisianagov Third Quarter. The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and.

Tobacco Tax Return for Retail Dealers of Vapor Products LA Revenue Account Number Mail to. File your clients Individual Corporate. 1 Total state death tax credit allowable Per US.

Some states levy an inheritance tax on money or assets after they are passed on to a persons heirs. The tax begins when the combined transfer exceeds the. REV-720 -- Inheritance Tax General Information.

While the estate is.

Free Louisiana Bill Of Sale Form Pdf Word Legaltemplates

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

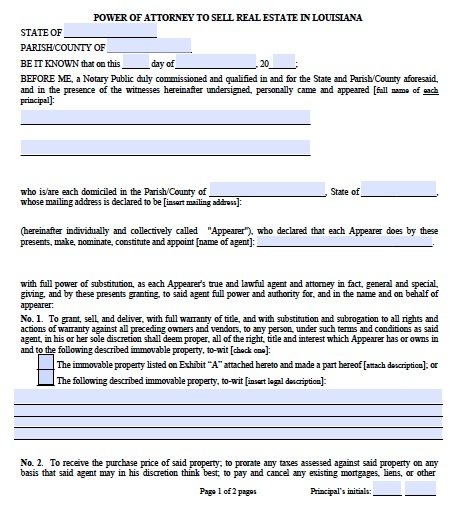

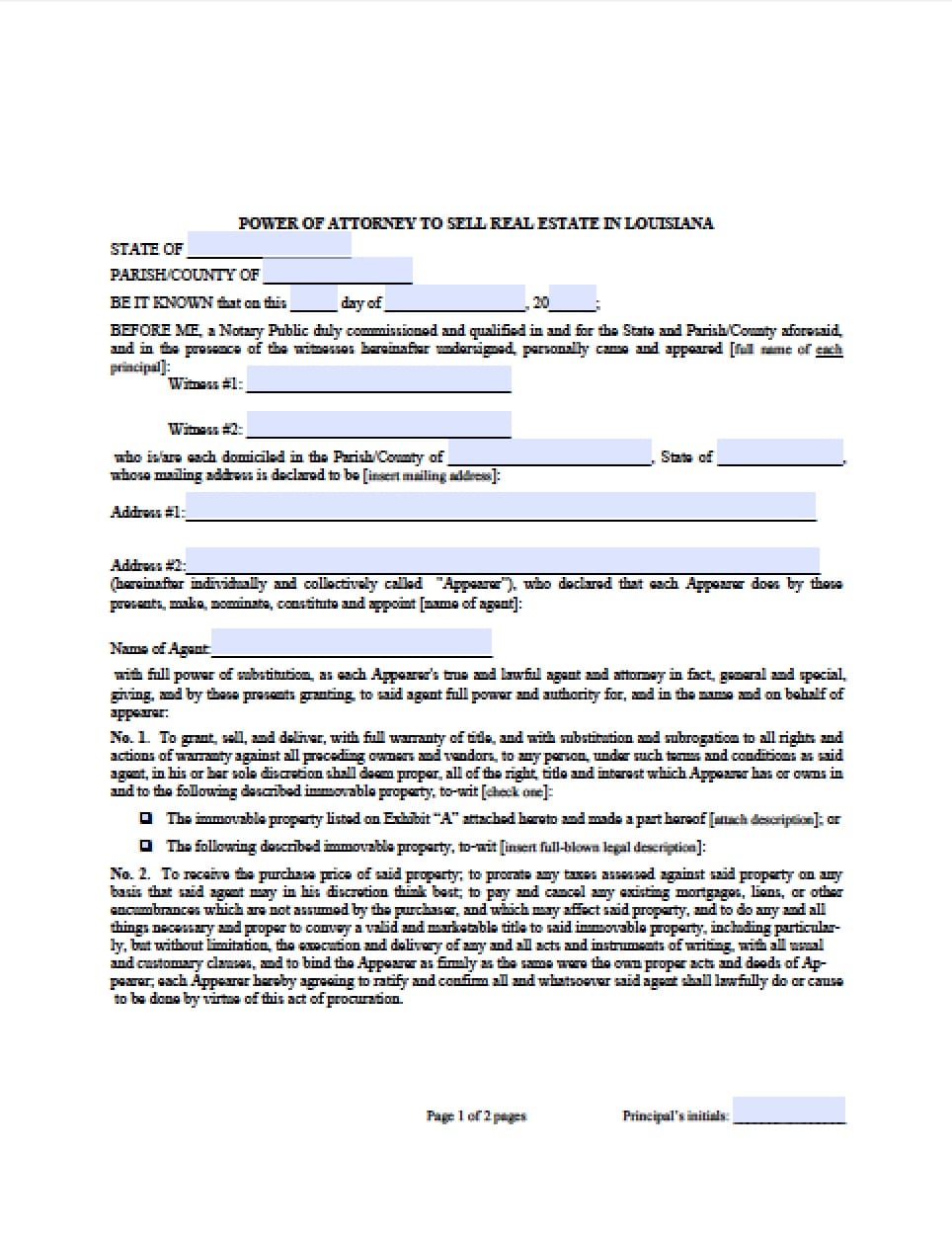

Free Real Estate Power Of Attorney Louisiana Form Pdf

Free Louisiana Bill Of Sale Forms 5 Pdf

Louisiana Sales Tax Small Business Guide Truic

Louisiana Health Legal And End Of Life Resources Everplans

It Nr Inheritance Tax Return Non Resident Decedent Pages 1 41 Flip Pdf Download Fliphtml5

Individuals Louisiana Department Of Revenue

Form R 3318 Inheritance And Estate Transfer Tax Return

Louisiana Real Estate Only Power Of Attorney Form Power Of Attorney Power Of Attorney

:max_bytes(150000):strip_icc()/1040-NR2021-59bde80441114cfa9cb43d182e899b8b.jpeg)

Form 1040 Nr U S Nonresident Alien Income Tax Return Definition

Free Louisiana Living Will Make Download Rocket Lawyer

Estate Taxes New Orleans Orleans Parish Louisiana Lawyer Attorney Law Firm

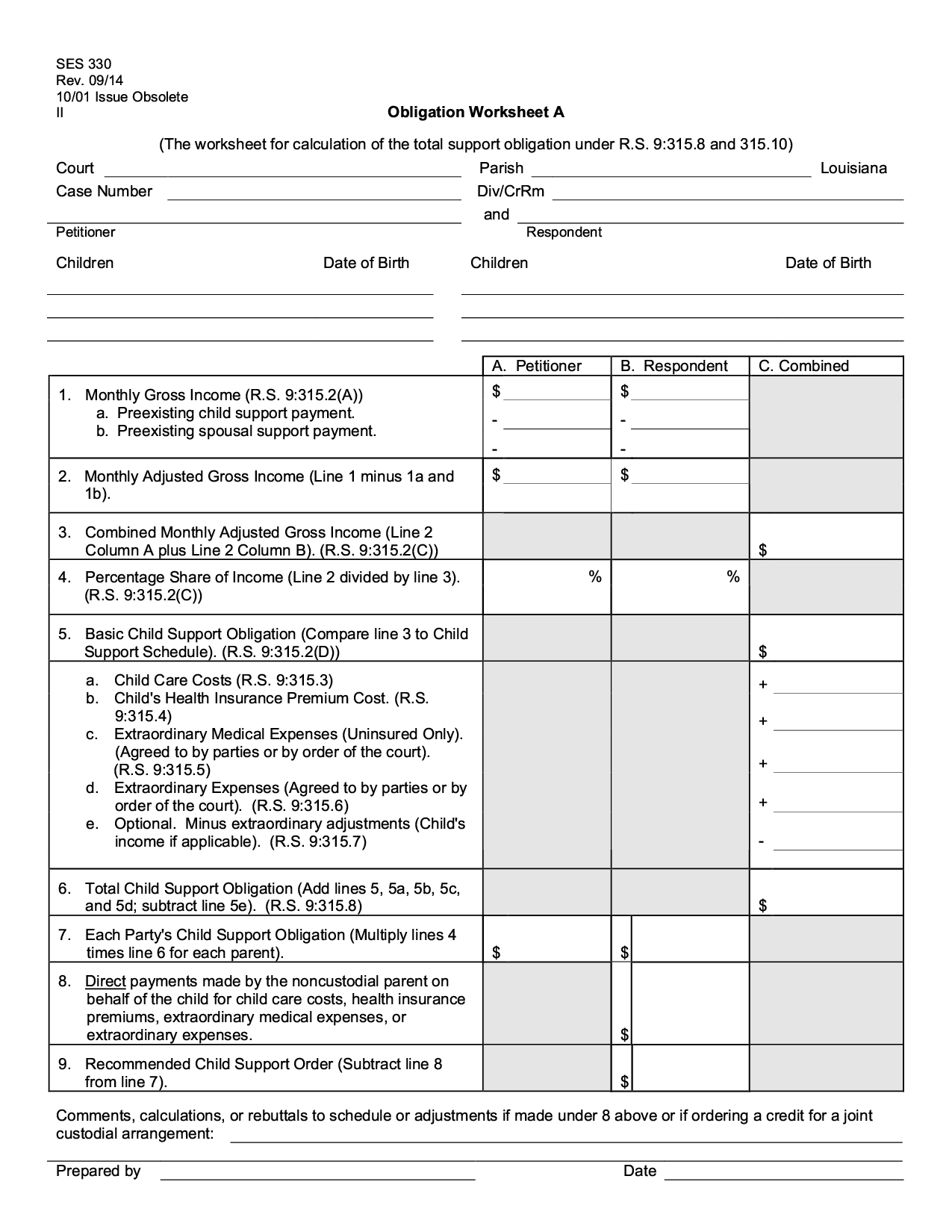

Louisiana Child Support Professional Thorpeforms

Louisiana Successions A Brief Explanation

Louisiana Income Tax Reporting And Audit Regime Updated